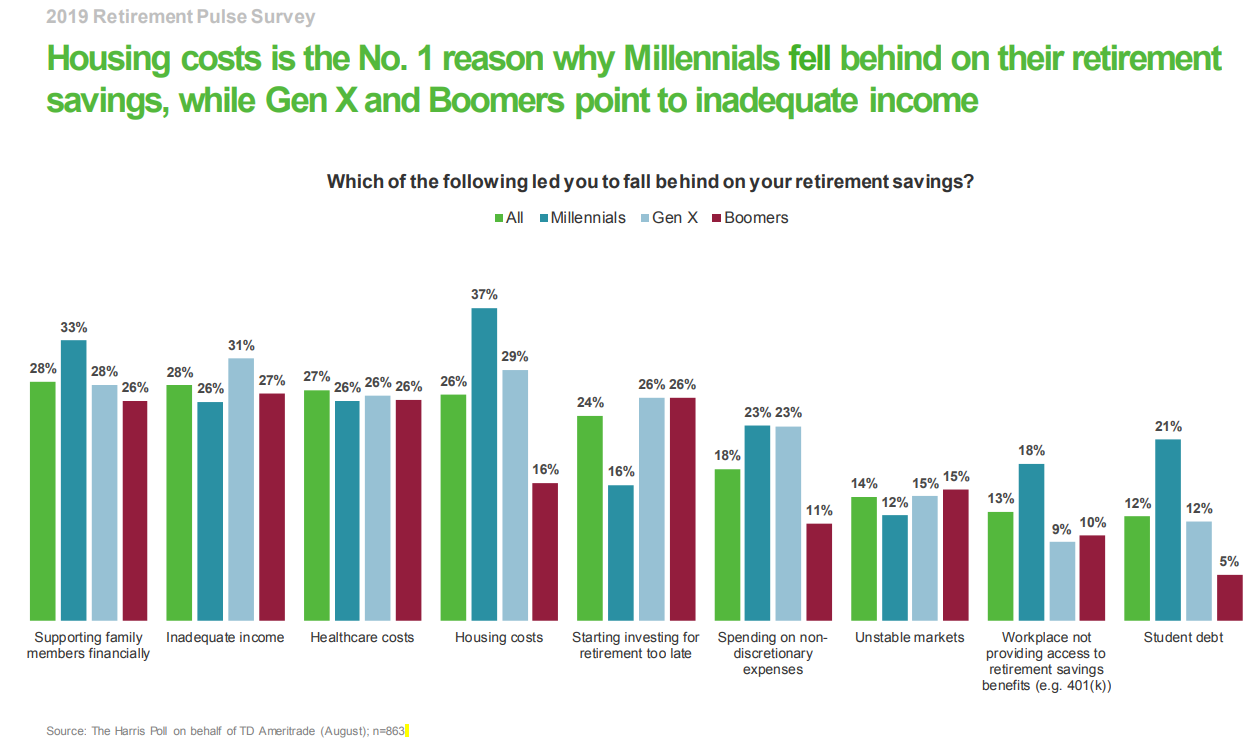

Housing, not Debt, #1 Reason Millennials Fall Behind on Retirement Savings

[ad_1]

Much has been made about the rising cost of student loan debt and the pressure it has put on the ability for Millennials to save for retirement. Coming out of college and almost immediately owing (in some cases) mortgage-level payments for your education puts you behind the eight ball. The issue has garnered enough attention as to become platform talking points for presidential candidates, and to raise calls for paths to loan forgiveness in order to strengthen future generations’ retirement prospects.

So it may come as a surprise that a recent survey by TD Ameritrade found that debt is NOT the #1 reason cited by Millennials for falling behind on retirement savings. In fact, housing costs is a more common roadblock for that generation.

[ad_2]

Source link