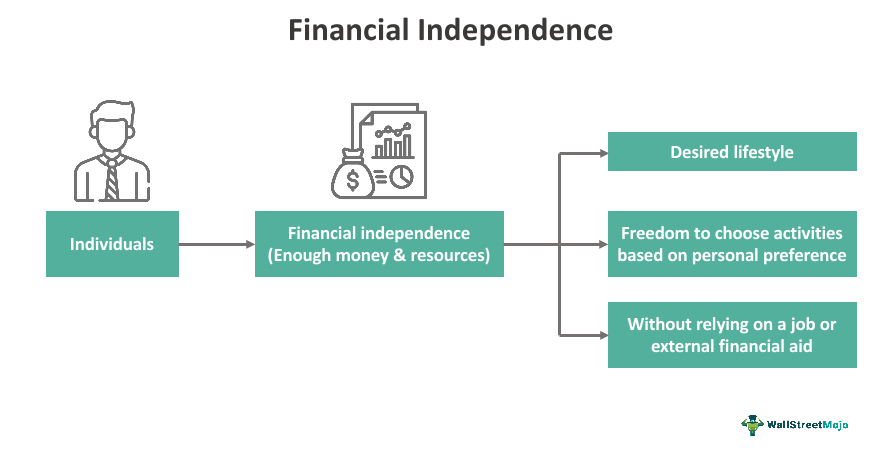

Financial Independence

Let us look at a few examples to understand the concept better. Example #1 Let’s say Daisy, a recent college graduate working as an accountant, is planning to build financial independence. Daisy creates a budget to track her income and expenses, establishes an emergency fund to cover unexpected expenses, and pays off student loans and […]

Financial Independence Read More »